By learning the tax exemptions and discounts youre eligible for you could lower your. Over-55 Home Sale Exemption.

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

1 This transmits revised IRM 46112 International Program Audit Guidelines Foreign Investment in Real Property Tax Act.

. How CGT affects real estate including rental properties land improvements and your home. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale. Your main residence home Find out if your home is exempt from CGT and what happens if you rent it out.

Property tax sometimes called an ad valorem tax is a tax on real estate and some other types of property. By learning the tax exemptions and discounts youre eligible for you could lower your capital gains tax from investment property youve decided to sell. Youre likely to have a capital loss if your adjusted basis is particularly high and losses can be used to offset capital gains on other property.

Heres how it works and how to avoid a big tax bill. Did you inherit the property after 20 August 1996. Expats can slash money of their NRCGT bills thanks to rebasing the value of land and property in the UK for tax purposes on April 5 2015.

Before enactment of the new tax law certain exchanges of personal or intangible property qualified as like-kind exchanges. Property and capital gains tax. Here are five ways you can do this legally.

In 2021 for instance this could result in a capital gains tax bill of 37500 if you sold that 100000 property for its 350000 current fair market value. Individuals who met the. This means that you would be able to sell the property within the six-year period and be exempt from paying capital gains tax just as you would if you sold the house considered your.

Providing the Guidelines in Determining Whether a Particular Real Property is a Capital Asset or an Ordinary Asset Pursuant to Section 39A1 of the National Internal Revenue Code of 1997 for Purposes. Local governments typically assess property tax and the property owner pays the tax. Avoid Capital Gains Tax on Real Estate in 2022 The money you make on the sale of your home might be taxable.

Did the deceased acquire the property before 20 September 1985. Paying taxes is an obligation but that doesnt mean you should pay more than you owe. Go to question 6.

Long-term capital gains tax rates are based on your income. Go to question 5. The capital gains tax property 6-year rule allows you to use your property investment as if it was your principal place of residence for a period of up to six years whilst you rent it out.

Its the gain you make thats taxed not the amount of. Capital gains tax is a tax you pay to the government when you make a profit by selling your investment property or something else of value for more than you originally paid for it. Keeping records for property Which records to keep for your property so you can work out CGT when you sell it.

The less youll pay in the way of capital gains tax when you sell and realize a profit. Another tax benefit of owning a rental property is the ability to defer paying capital gains tax and tax on depreciation recapture by conducting a Section 1031 tax deferred exchange. Taxpayers will pay 15 in long-term capital gains tax if they exceed these income thresholds.

From the time the deceased acquired the property until their death was the property their main residence and not used to produce. 350000 less your 100000 basis 250000 times 15. Go to question 4.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Gains of less than 50000 are charged at a rate of 18. So are securities with events such as a.

Normally when a rental property is sold the depreciation expense is recaptured and taxed as ordinary income to an investor up to a maximum rate of 25 percent depending on the investors federal. REPUBLIC OF THE PHILIPPINES DEPARTMENT OF FINANCE BUREAU OF INTERNAL REVENUE Quezon City December 27 2002. Go to question 3.

The over-55 home sale exemption is an obsolete tax law that provided homeowners over the age of 55 with a one-time capital gains exclusion. A transition rule in the new law provides that gain may be postponed on a. Material Changes 1 Rewrote IRM 461121 to conform to new requirement to include internal control information at the beginning of the IRM.

Property values for NRCGT. Under the Tax Cuts and Jobs Act a trade is not a like-kind exchange unless the taxpayer trades and receives real property other than real property held primarily for sale. For example if you spent 310000 on buying a house years ago and sold it for 500000 today then your capital gains would be 190000 and youd have to declare this amount along with your.

Real property is not the only asset whose cost basis is subject to adjustment.

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Canada Capital Gains Tax Calculator 2022

Capital Gains Yield Cgy Formula Calculation Example And Guide

How Capital Gains Tax Works In Canada Forbes Advisor Canada

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Understand The Lifetime Capital Gains Exemption

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

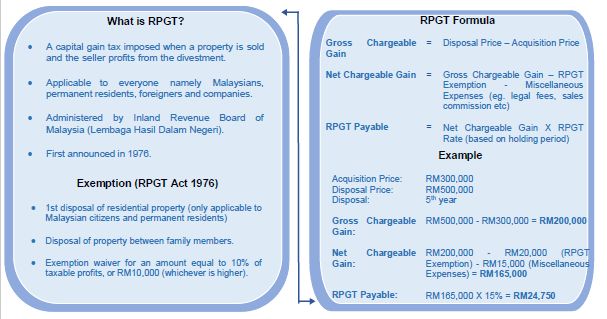

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

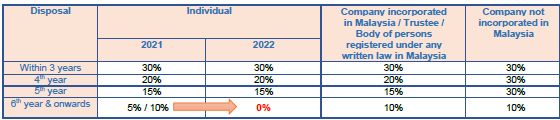

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

State Taxes On Capital Gains Center On Budget And Policy Priorities

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Capital Gains Tax What Is It When Do You Pay It

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)